Weekly Crypto Market Report: April 18-24, 2022 - BTC, ETH, COMP & More

Market Fundamentals Analysis

This weekend did not provide the life that the crypto market has been searching for, with most coins sliding 2-3% on minuscule volume, just a bit above 30% on the majors. This has been a real issue for the crypto markets, recently, with the volume on crypto dragging even while other assets have been fairly volatile. It has been conference season, with Bitcoin Miami, DevConnect Amsterdam, and Paris Blockchain Week in the recent rear-view mirror, and that has many traders on the road. The conference season will continue this week, meaning unless we get an actual catalyst, there’s a fair chance BTC could be fairly quiet.

Despite realized volume cruising along at 40% over the past week, implied volumes have held onto the 50% level and actually traded up to around 55% over the weekend in the short-dated expiration. This move was mostly driven by put buyers, with the put continuing to trade over on the risky side by as much as 5% over the weekend.

At Compound, a governance proposal just barely failed, with 499k votes against and 492k for. This proposal would have ended the COMP rewards for Compound users. The fact that this debate came about, and came so close to passing, is a striking admission to the drawbacks of liquidity rewards as an incentive mechanism, especially given that yield farming as a phenomenon got started on Compound back in 2020. Rewards can be a strong tool to bootstrap liquidity, but in the long run, leads to consistent sell-side pressure. In other developments, Ethereum passed another test this weekend, with a second successful shadow fork, a strong step toward the Merge.

Daily headlines continue to underline that institutional interest in the crypto space remains supported. Just last week, Grayscale CEO Michael Sonnenshein, stated that it’s a matter of when, not if, the SEC approves its spot BTC ETF. The approval of a BTC futures ETF under Teucrium earlier this month by the SEC has been looked at as somewhat of a potential precursor to Grayscale’s spot BTC ETF, given that it was filed under the Securities Act of 1933 — the law under which spot BTC ETFs have been filed. Needless to say, approval of a spot BTC ETF would be a huge catalyst for positive price action in BTC and crypto in general. The deadline for approval by the SEC will be July 6th.

We will see this week if bulls can reclaim the support level of 40k and 3k for BTC and ETH respectively. Do take note that US Fed Chair Powell is expected to speak soon, the final speech ahead of the pre-meeting quiet period before the next FOMC meeting on May 3, 2022. He could very well confirm speculation that the US will raise interest rates by 50bps on their next meeting – confirming a May hike of anything less than that will undoubtedly be bullish for risk assets and crypto.

Overall, the market continues to be in a consolidation phase and seems to have lost steam. The inability to move in any particular direction has investors both confused and results in them being cautious. The rate game with the FED, along with the macroeconomic outlook, has dampened volumes and institutional flows.

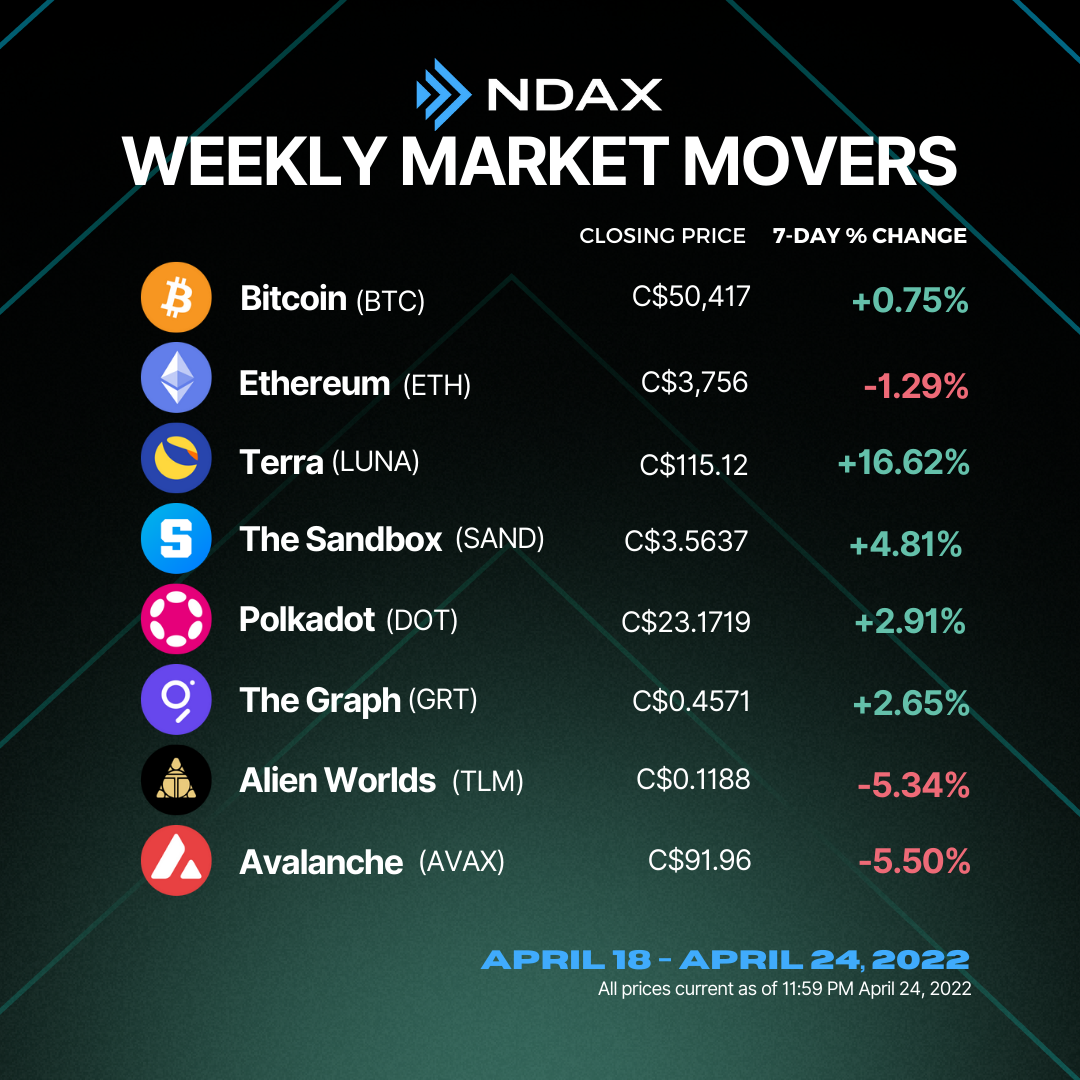

Weekly Snapshot

Market Updates

- Exmo, a U.K.-based crypto exchange with an extensive presence in Eastern Europe, is pulling out of Russia, Belarus and Kazakhstan.

- Bitcoin’s hashrate tapped a lifetime high this weekend reaching 271.19 exahash per second (EH/s) on Saturday, April 23 at a block height 733,197.

- In an interview, the sitting French President voiced his support for MiCA regulation and the digital euro project.

- European Union officials discussed banning Bitcoin (BTC) trading during a debate on a proposal to ban proof-of-work (PoW) mining, according to documents obtained through a freedom of information request.

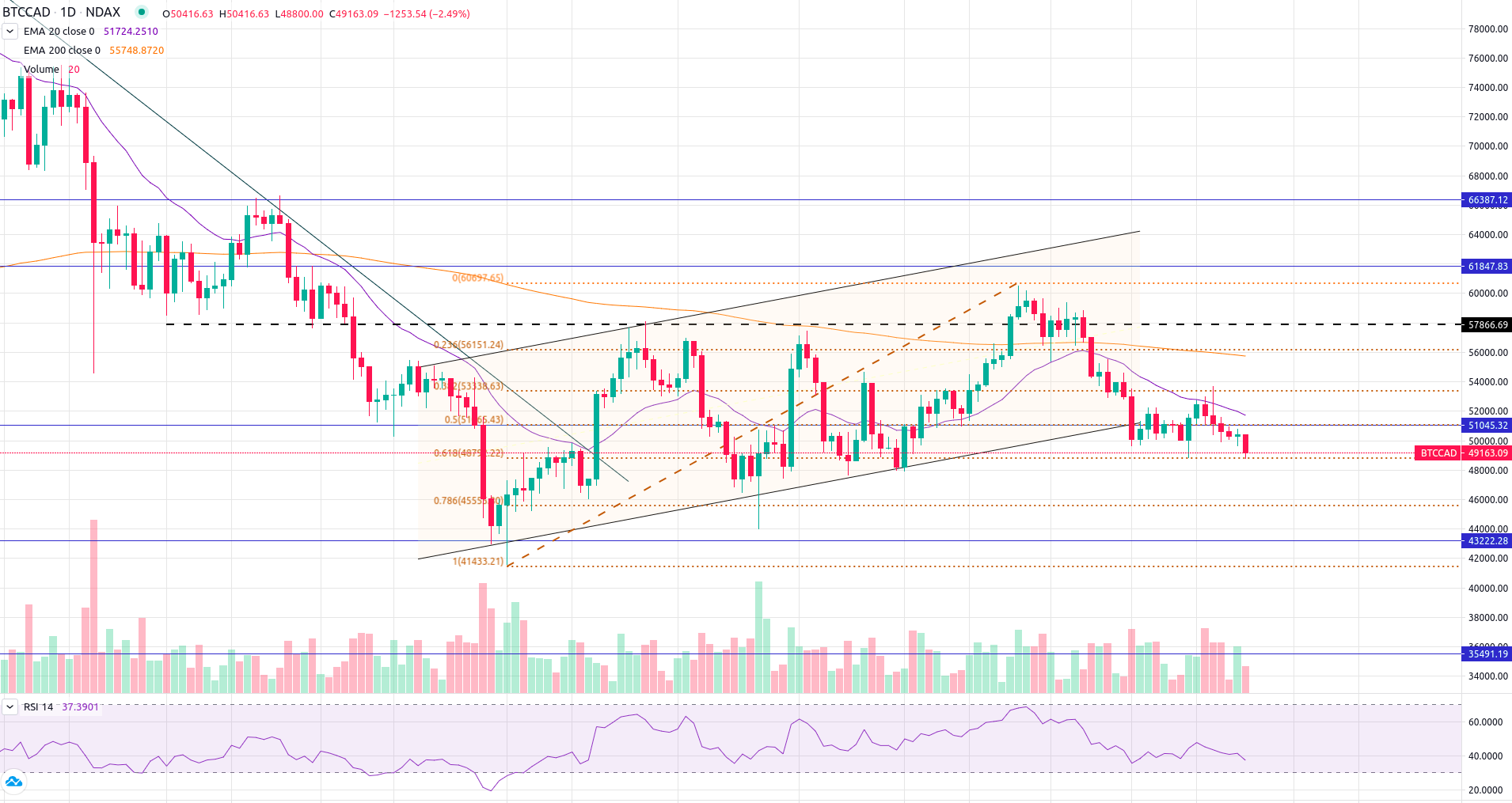

Bitcoin Technical Analysis

Bitcoin slipped below the psychological level of C$50k and made the low of C$48,800. Technically, on a daily chart, the asset is trying to take support at the key level of C$48,790 (61.8% Fibonacci Retracement Level) and the lower shadows around the support indicate short covering can be on the cards. If BTC holds and sustains above C$48,790 then we can expect a bounce whereas a break or close below the support will lead to the further downfall and the prices can slide to C$47k - C$45k levels. Declining volumes, Falling Moving Averages, and RSI in the negative territory indicates that the bears have the upper hand.

Key Levels:

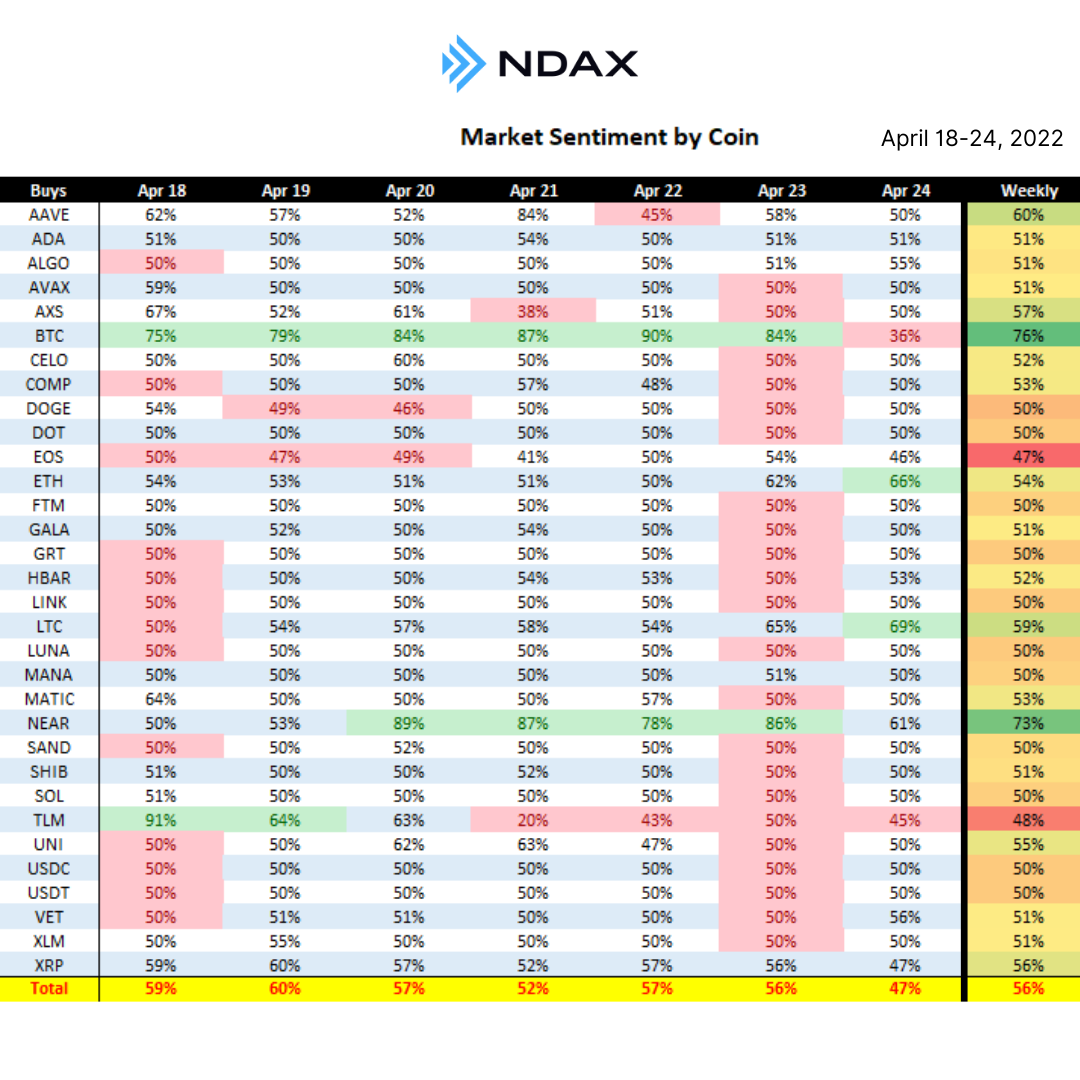

Weekly Sentiment by Coin

NDAXers this week embraced the BUY button on our trading platform.

With 56% of this week's transactions on NDAX were buy orders, here are several notable standouts including BTC consistently in the green six of seven days with the sentiment at 76% buying, while NEAR followed at 73% long. Additional mentions include UNI, AAVE, AXS, XRP and LTC ranging long from 56-60%.

For the latest cryptocurrency prices, check out NDAX's Markets page.

Disclaimer:

Information provided in the weekly market report is for information purposes only and should not be interpreted as investment, legal, or tax advice. Prior to investing, it is very important to evaluate your investment objectives and your risk tolerance carefully. This technical report is not meant to provide guarantees of future performance, and users should not rely on it, as the actual performance and financial results may differ significantly.