Weekly Crypto Market Report: March 7 - 13, 2022 - BTC, ETH, LUNA, FTM & More

Market Fundamentals Analysis

A quiet weekend was disrupted by a sharp 2% selloff in BTC as the market got details on today’s EU Parliament vote to put forward a draft on MiCA frameworks. This draft has a focus on sustainability of mining, and could act as a pretext for a ban on cryptocurrencies that rely on proof of work. Of course, we are in a market where crypto assets are highly correlated to each other, but fundamentally this headline should affect PoW and PoS stakes in very different ways. At the very least, we could see correlations trend lower this week. Implied vol on BTC rallied sharply at the front of the curve, with a more muted reaction for longer-dated options.

The sharp pullback in BTC and large-cap altcoins suggest that bears have yet to capitulate and that traders continue to sell the top of each breakout. Crypto resumed tracking other risk assets over last weekend as the news out of Ukraine continued to weigh on risk sentiment. Vols have stayed elevated across the board since weeks after reports that fires had broken out at one of Ukraine’s nuclear power plants.

Signs of potential changes to US foreign policy stances to other oil producers like Iran and Venezuela over the weekend should indicate just how incredibly deep is the political anxiety over $4.00 gasoline.

With regard to the Fed, it’s hard to see even the most aggressive inflation hawks being blind to the demand destruction caused by a sharp 50% hike in energy prices. In the past, the Fed has sought to move off the zero bound in order to produce buffers to cut in times such as these.

Over the week, several major alts have seen interesting trends form. Terra (LUNA) skyrocketed to a new all-time high on March 9, but immediately, profit-booking at higher levels was seen. The bulls again tried to resume the uptrend the next day, but failed. The inability to cross and trade above the C$133 may have attracted profit-booking. This pulled the LUNA below the critical level at C$110. If bears continue to control the asset, the asset may fall to its 20 day EMA, at C$102, and with no momentum, can also further fall to C$90, unless bulls can regain some control. However, on the upside if the asset trades above C$125 convincingly, it can target the C$145 mark.

Fantom (FTM) has seen a significant correction over the past week. This dump came after the foundation affirmed that DeFi developer Andre Cronje would be leaving the space. The asset has fallen close to 20% in the past week. At current levels too, bears seem to be in control. RSI is negative, and the asset is trading at its next support level, at C$1.35. If it beats this, the asset could further fall to C$1.

XRP closed above the downtrend line on March 9, but the bull failed to press on. Bears pulled the price back convincingly thereafter. However, the bulls haven’t allowed the asset to break the crucial 50 day SMA level of C$0.96, which suggests buying at lower levels. If a recovery sets in, and the asset beats the C$1.05 mark, we can see XRP rally to C$1.15 rather quickly, and then a surge to C$1.3.

The broader macroeconomic fear/disarray is an opportunity to gently scale into risky assets at attractive prices. The overall sentiment isn’t necessarily bearish, but more of caution. Traders are buying the dips, hence markets continue to be in a consolidatory phase. Given the macroeconomic uncertainty, this is not a bad thing, but in fact a sign of maturity, and confidence among long term investors.

Weekly Snapshot

Market Updates

- The legal standing of Bitcoin mining in the European Union hinges on the results of today‘s vote in the European Parliamentary Committee on Markets in Crypto Assets (MiCA).

- Bank of Israel published a draft regulation on Anti-Money-Laundering and Combatting the Financing of Terrorism (AML/CFT) risk management for the banks facilitating crypto-to-fiat transactions.

- Fantom Foundation issues a clarification statement about the departure of Andre Cronje and Anton Nell.

- Bitfinex, an affiliate firm of the world’s largest stablecoin provider, Tether (USDT), will not unilaterally freeze the accounts of ordinary Russian customers as part of the global sanctions unless it's forced to do so.

Bitcoin Technical Analysis

Bitcoin, after making the ‘Spinning Top’ candle at the key resistance level of C$57,500, witnessed a sharp correction and the prices dropped below the psychological level of C$50k making the low of C$47,985. However, it did not break the previous low of C$47,652 and bounced back up.

Technically, on a daily time frame, the asset is trading in a ‘Rising Channel’ pattern and is hovering around the lower ascending trendline (support of the rising channel). If the prices bounce from the support line then we may expect the bulls to resume the up-move, whereas a break below the channel will lead to further downfall.

To witness a good rally, BTC needs to close and sustain above C$58,000. The declining volumes, flat Moving Averages and RSI around 50 indicates a neutral stance for the asset.

Key Level:

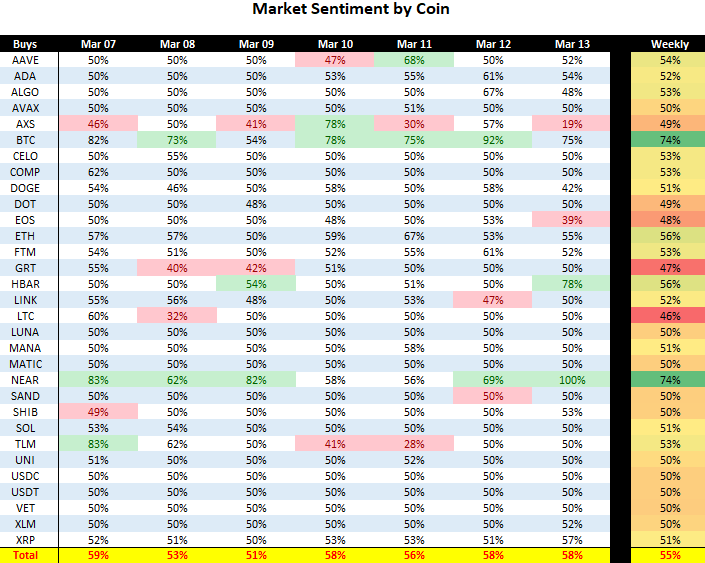

Weekly Sentiment by Coin

This past week on NDAX saw positive sentiment for BTC and NEAR, as both assets saw 74% of their trades being buy orders. While most coins hovered in the 50/50 zone, GRT and LTC led sell offs with 53% and 54%, respectively.

Overall, NDAX traders are buying the dip with 55% of total volume being buys.

For the latest cryptocurrency prices, check out NDAX's Markets page.

Disclaimer:

Information provided in the weekly market report is for information purposes only and should not be interpreted as investment, legal, or tax advice. Prior to investing, it is very important to evaluate your investment objectives and your risk tolerance carefully. This technical report is not meant to provide guarantees of future performance, and users should not rely on it, as the actual performance and financial results may differ significantly.