Weekly TL;DR - Aug 1 to Aug 7, 2022 - BTC, ETH & more

BIG PICTURE

Spoiler alert–this week we’re talking about bitcoin, institutional adoption and the american economy. Sorry!

Bitcoin started the week up 3.5% from the last, which produced a 6 week high… And while BTC spent last week largely consolidating from said 6-week high, we have been making higher highs and higher lows. But judging by open interest on call and put options, Ethereum is definitely stealing the show right now.

MARKET FUNDAMENTALS

On Thursday, BlackRock and Coinbase announced a partnership to bring Bitcoin custody, brokerage and trading services to BlackRock and their clients.

- As of last week’s close, COIN had one of its best weeks of all time (up 58% WoW)BlackRock has $10T AUM…

- And it’s trade platform Aladdin (to which Coinbase is to be integrated) is used by BlackRock clients totalling an additional $10T AUM.

- Bitcoin can now be purchased directly, without any additional hoops to jump through, by a new pool of $20T of institutional capital.

- Hot dang!

Everyone’s favorite Bitcoin Ambassador Michael Saylor steps down as MicroStrategy CEO to focus on Bitcoin

- Saylor founded business intelligence firm MicroStrategy in 1989, making him one of the longest running tech CEOs of all time.

- Saylor wants to focus on the company’s Bitcoin acquisition strategy and its Bitcoin evangelism efforts.

- He will continue as Chairman of the board (he holds over 60% of the company’s voting shares) while current President Phong Le will resume the role of CEO.

BTC & ETHER: Tick tock, new block.

- BTC is up 3.5% WoW, 8.5% MoM

- ETH is up 7.5% WoW, 40.5% MoM

- Puffed up on Merge hopium, open interest in Eth futures has surpassed that of BTC!

- More on these exotic options dynamics here: NYDIG Research

Fund Inflows for the First Half of 2022 have already surpassed all of 2021.

- According to a recent research report by top industry data and analytics firm Messari

- More than $30 billion was raised from 1199 funding rounds in the first half of 2022.

- What do we mean exactly by inflows? VC, JV, Investments… Picks and Shovels.

- The Breakdown? $10.3B in CeFi (Exchanges, Payments, Market Makers, Savings, etc)

- $8.6B for Web3 and NFT Infrastructure (incl. $4B in Gaming!) and $1.8 for DeFi

- Additionally, PWC estimates that 38% of Hedge Funds are now investing in Digital Assets vs. 21% in 2021.

US Jobs Data.

- The US Economy produced over 500k new jobs in July. In this economy? Oh my.

- But is this, economically speaking, bullish? I.e. Does it mean that companies are growing? Or that nobody wants to work…

- Further, July job numbers also showed a disproportionately large amount of people quitting their jobs in June, so your guess is as good as ours, the white house’s, or the FOMC’s.

- Yes American unemployment numbers are at decade long lows, but these numbers only famously include people who are still *actively* looking for work, and not those who have altogether given up.

- We refer you to the old pandemic ‘Great Resignation’ chestnut for further research on this topic.

- July CPI Numbers come out on Wednesday Aug 10th

- Next FOMC meeting is scheduled for mid-Sept.

Futurist Conference is here, hooray! Stay tuned this week for a ton of exclusive coverage.

- NDAX is a title sponsor.

- NDAX COO Tanim Rasul is one of the speakers, and will be discussing bear market investment best practices.

- IF YOU REALLY HAVEN’T YET PICKED UP YOUR TICKETS, we can’t help you anymore...

- But if they still exist, use code NDAX25 for a 25% discount.

- Come say hi Tomorrow and Wednesday!

MARKET UPDATES

REGULATORY:

- Bipartisan Bill Pushes to Give More Sway Re: BTC / ETH to CFTC - Bloomberg

- NY AG Calls for Crypto Whistleblowers to Come Forward - The Block

INDUSTRY NEWS:

- $1B: Brevan Howard Scratches Together Largest Crypto Hedge Fund Raise to Date - Blockworks

- 2022 H1 Fund Inflows Outpace All of 2021 - CoinTelegraph

- Saylor Steps Down as CEO to Focus on MicroStrategy’s Bitcoin Strategy - Blockworks

THE TAKEAWAY

This week was a veritable spate of good news. Sure the NY AG is calling for ‘Crypto Whistleblowers’ to come forward, (ostensibly to score political points in an already firmly anti-crypto state?) but in crypto that’s just a Tuesday.

- The world’s largest asset manager adding Bitcoin to their menu (via Coinbase integration to their Aladdin platform)

- The largest ever crypto raise by a hedge fund (from TradFi no less)

- Crypto Fund inflows growing at twice the pace of 2021…

And these in the depths of a brutal crypto winter within a probable worldwide recession.

Indeed, this week’s news is hard to take with a grain of salt, friends, but take it thus we must. We don’t know what’s in store for next week. We don’t know if Ethereum can pull off “changing the engine of the airplane mid-flight” in September. We don’t know how far a J Pow or Politician will go to save their career. And we certainly don’t know which next domino piece falls–or in which direction. No one does.

What we do know, what we can control, is how many Satoshis we can afford to stack in a week, and what not to let ourselves get too prematurely excited about.

Stay humble & stack sats, hydrate, and don’t forget to SPF.

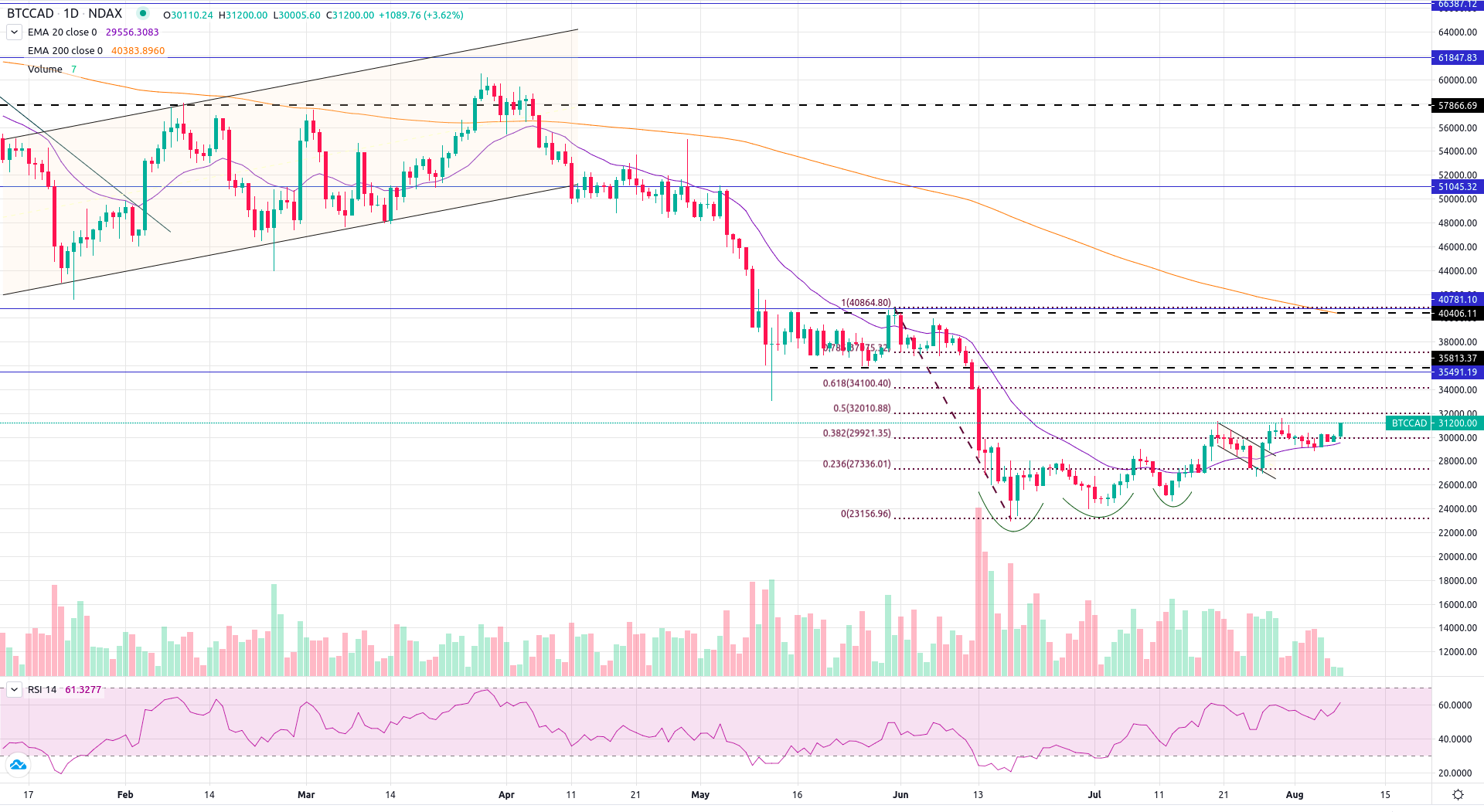

BITCOIN TECHNICAL ANALYSIS

BITCOIN’s been consolidating in a range since its recent 6 week high around $31.5K

- Daily, bottoms are forming ‘Higher Lows’, while ‘Swing Highs’ are getting higher.

- But BTC is experiencing stern resistance around C$32k.

- If BTC holds its 20-Day Moving Average as support (C$29.5K)...

- We can expect Bulls to push BTC further up past resistance to C$36K, or–

- If that fails, as far down as C$26.5K (where there is strong support).

- Declining volumes, flat moving averages and RSI around 50 indicates indecision and a neutral stance for the asset.

KEY LEVELS:

Disclaimer: This content is not intended to provide investment, legal, accounting, tax or any other advice and should not be relied on in that or any other regard. The information contained herein is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of cryptocurrencies or otherwise.